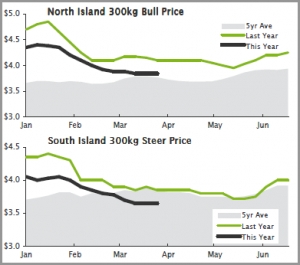

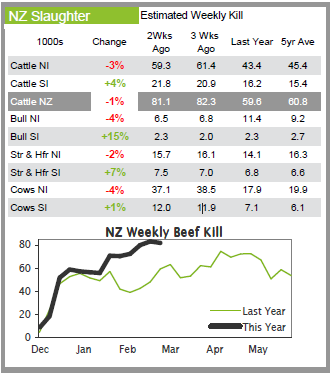

But the kill dropped week on week for the first time since early February and reports indicate that backlogs are clearing and future bookings are reducing very quickly. As a result killing space is expected to free up considerably over the coming weeks. This will result in upward pressure on farmgate prices as meat companies compete more strongly for a declining kill. One North Island company lifted their beef schedules by 15c/kg last week. A steep reduction in kill is also likely to provide some price support to US imported beef prices. Winter contracts are providing some more indications of price expectations with one contract at $4.40/kg for steer in September.

US imported cow meat returns on the up

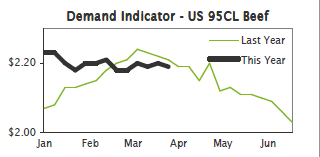

US domestic cow supplies are seasonally subsiding and prices have been appreciating as a result. US domestic 90CL cow returns are currently pegged at US$2.18/lb and are expected to go higher with the USDA's latest Livestock, Dairy & Poultry Outlook predicting cull cow prices will continue to increase through to the second quarter of 2013. Strong US domestic cow meat prices are helping to drag up imported returns with imported 90CL cow prices jumping US6c/lb in just the last 3 weeks. But US imported 95CL bull prices are under pressure as there is increased competition from 95CL cow meat offerings. Normally cow meat is packed as 90CL but the drought has seen more light cows come forward and this lean meat is perfect for the 95CL grade. 95CL cow meat is currently priced at US$2.16/lb so is a cheaper option over 95CL bull for those who need it in their formulations.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283.

|